Payment Fraud Trends

19 November 2024Introduction

Fraud is an escalating challenge in today’s digital-first world, impacting individuals, businesses, and governments globally. Defined under the Theft Act 1968 as the act of “obtaining property, money, or financial advantages through deception,” Fraud comprises a vast array of illicit activities aimed at financial gain. The shift to digital and online transactions since the early 2000s has introduced new forms of fraud and heightened exposure to risk. Phishing emails, fraudulent websites, and identity theft became common with the mainstream adoption of online banking and e-commerce, marking the beginning of a technology-enabled fraud landscape.

The data in this analysis starts from the year 2004 as this was the year when Google trends started data collection. The analysis of search volume data reveals a significant shift in public awareness and concern around payment fraud, and also coincides with the widespread adoption of online banking and e-commerce — two pivotal developments that laid the groundwork for the digital economy and introduced new risks for consumers and businesses. This period marked the beginning of digital fraud awareness, with initial spikes in interest that gradually stabilised as individuals and organisations adapted to this new digital landscape. This is particularly notable as the records on ‘Payment Fraud’ on Google trends start from 2004, although the occurrence of other forms of fraud far precedes this year.

Long-Term Analysis: 2004 to 2024

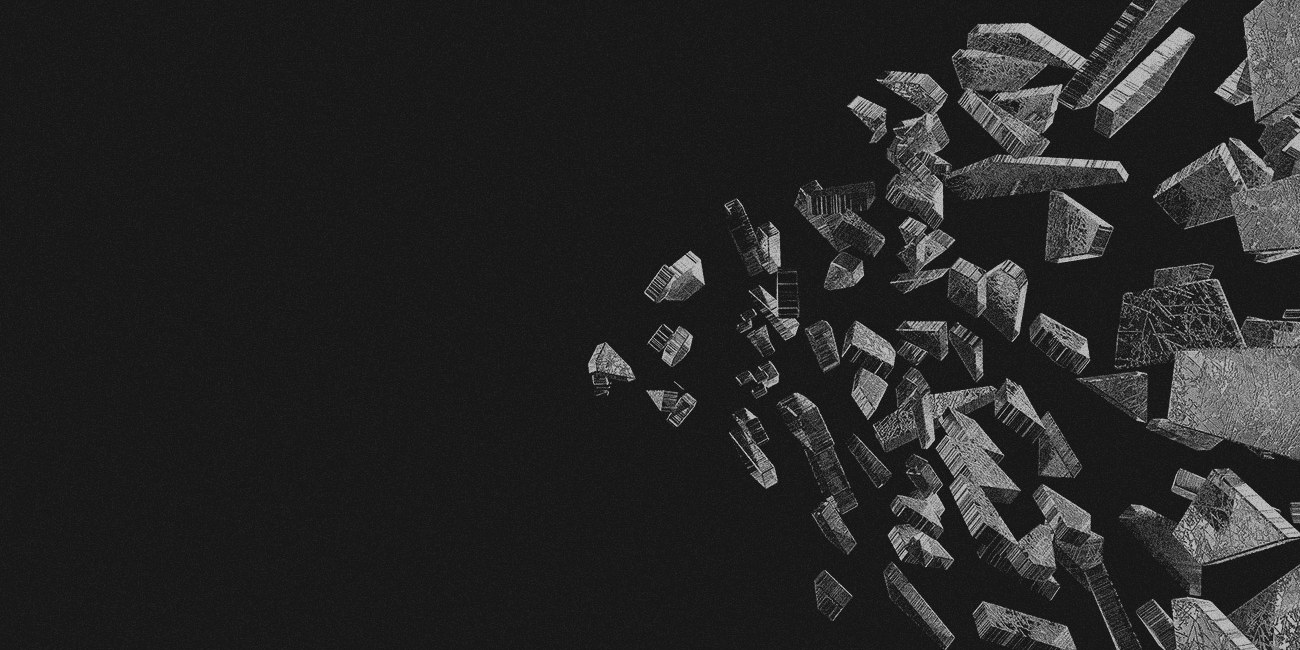

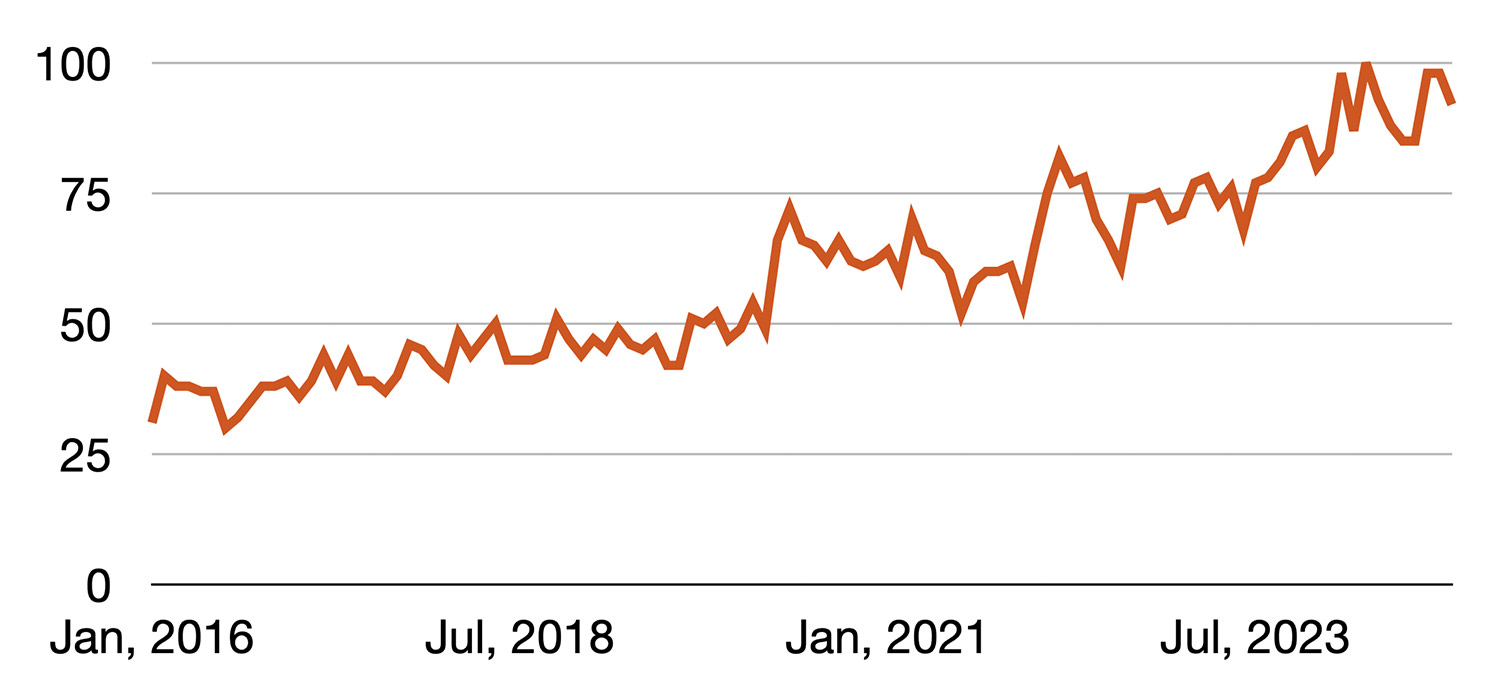

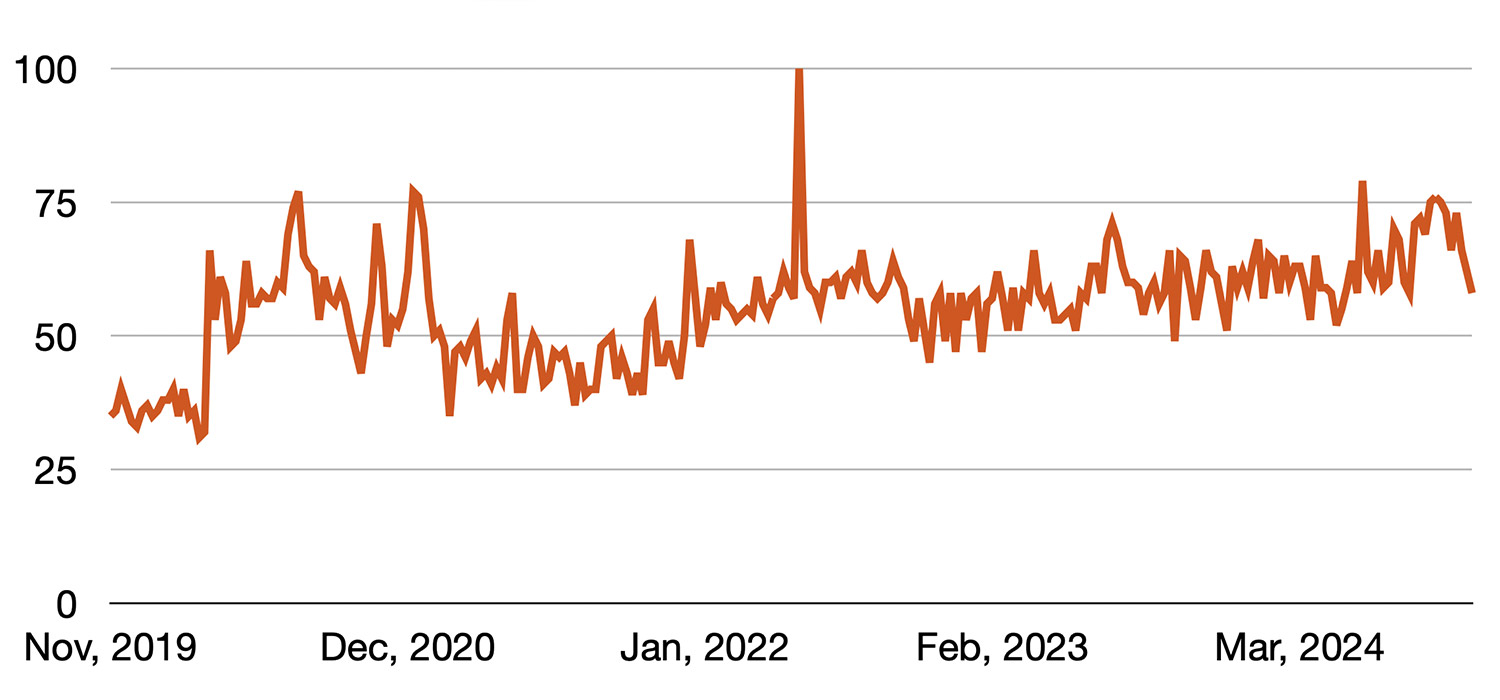

WORLDWIDE SEARCH VOLUME FOR “PAYMENT FRAUD” SINCE ITS FIRST SEARCH IN 2004.

Data Cited from - (Google Trends, 2024).

The scope of fraud has expanded dramatically over the past two decades. In 2004, fraud schemes largely relied on basic phishing and identity theft tactics. By 2024, annual fraud losses in the UK alone exceeded £10 billion, spurred by cryptocurrency-related fraud, high-speed online transactions, and evolving cyber-enabled scams. Institutional responses have also matured, with frameworks such as the UK’s Online Safety Bill enforcing tech company accountability for fraudulent activity on their platforms.

The diagram presented above shows the trends in search interest for a ‘Payment Fraud Trend’ from January 2004 through late 2023. Key observations/findings and possible interpretations from the data are outlined below.

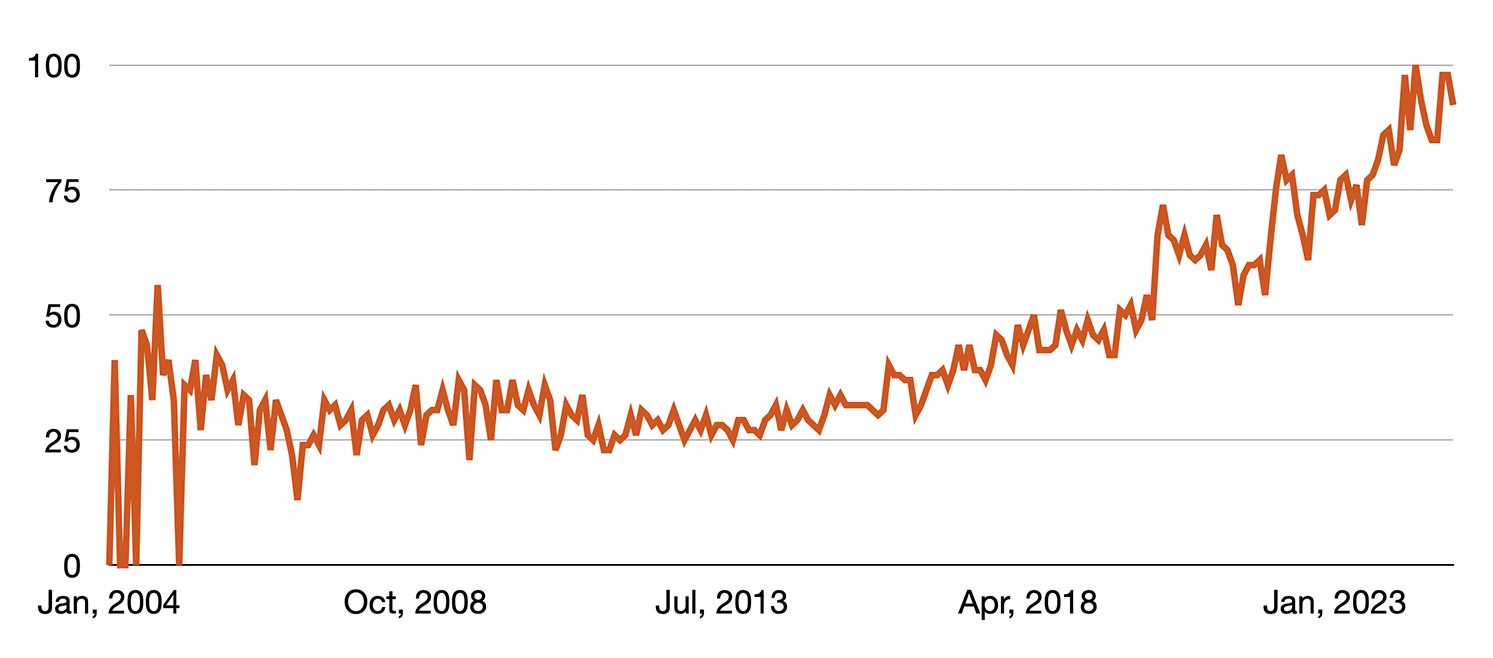

BASELINE AND EARLY VOLATILITY (2004 – 2008):

The early volatility likely mirrors the emerging awareness of digital payments and the initial stages of financial digitalisation.

Around 2004, the payments industry began shifting significantly with the introduction of foundational technologies that allowed digital transactions to gain footing. Innovations such as PayPal (founded in the late 1990s but really popularising online payments post-2002, after its acquisition by eBay) had a strong influence. Alongside emerging online payment platforms and early digital wallets and transformative innovations (such as Amazon 1-click), spurred public curiosity, leading to search spikes in digital finance themes. This is seen in the diagram as there appears to be an initial spike in interest that quickly fall back between the early years (2004–2008). However, because the ecosystem was still developing and adoption was sporadic, we can see that the initial search surges are without a sustained follow-up in – this is characteristic of a topic that was just starting to gain public attention but has not yet reached a level of consistent concern or media coverage.

Payment fraud incidents at this time did exist but were relatively low-profile and often targeted early adopters or specific industries. Key issues included phishing and card-not-present fraud in e-commerce, but they had yet to capture widespread public concern. It is also likely that the financial crisis shifted the focus public attention towards another topic reducing the search volume in payment fraud.

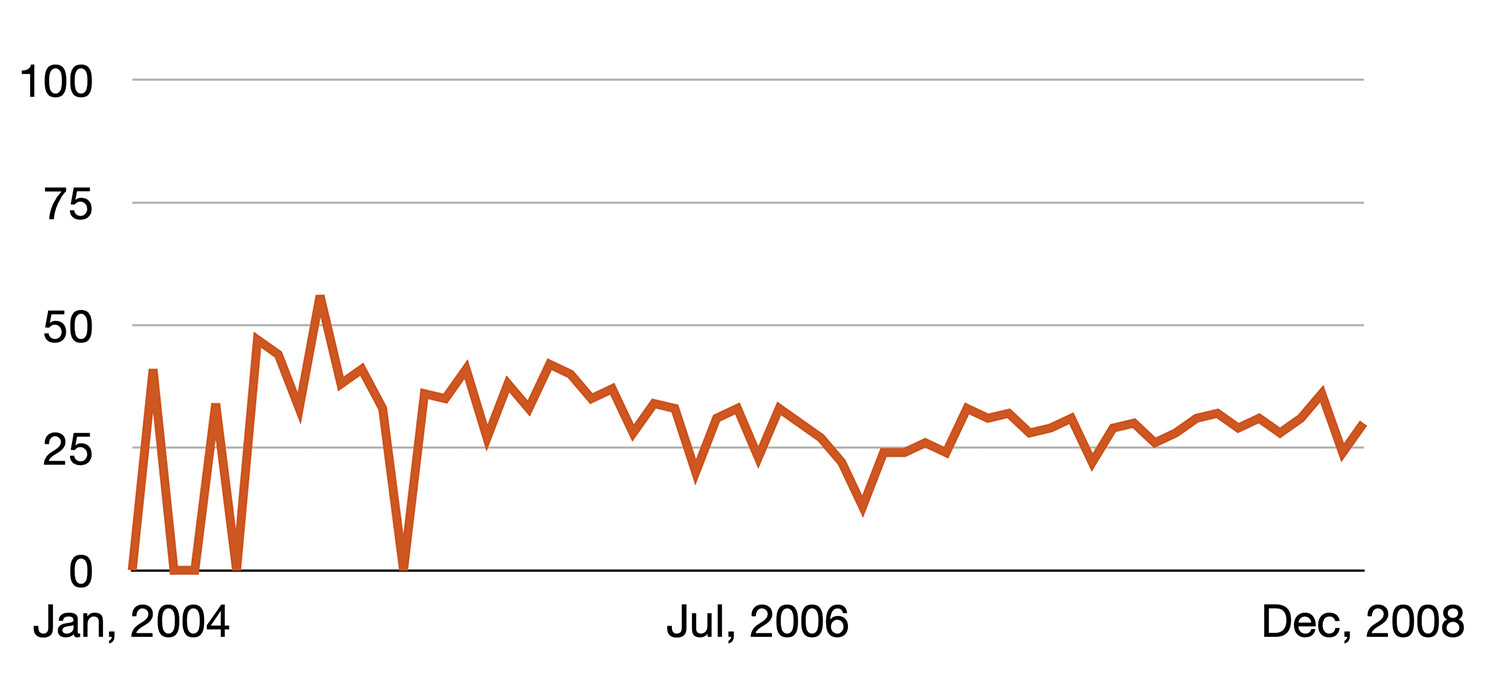

EXTENDED PERIOD OF STABILITY (2009 – 2016):

From approximately 2009 to 2016, search interest remains largely stable, with values fluctuating minimally.

This stability might indicate a phase where the topic maintained a steady but low-key presence in public discourse, without major events or developments drawing additional attention. In the digital payments and fraud prevention space, an extended period of stability observed between 2009 and 2016 in the Google trends data could correspond to a time when digital financial infrastructure and fraud prevention techniques matured but did not experience disruptive advancements or shifts in public attention.

This could suggest a period in which either digital payment or fraud-related interest was limited to niche audiences, such as industry professionals or tech enthusiasts.

INCREASING INTEREST AND UPTICK (2016 – 2024):

Around 2016, the graph shows a gradual upward trend, indicating a sustained increase in search interest.

Since 2016, there has been a sharp increase in search interest around fraud, which corresponds to the rapid adoption of new digital payment technologies and the rise of fintech platforms like PayPal, Venmo, and later, Cash App. These innovations, while offering more accessible and efficient financial services, have also created new avenues for fraud.

As digital payments and fintech services gained popularity, so did the exposure to fraudulent schemes. This includes tactics like social engineering, phishing, and synthetic identity fraud specifically targeting users of these platforms.

Fraud Trends in 2023 and 2024

DIGITAL FRAUD AND CYBERCRIME

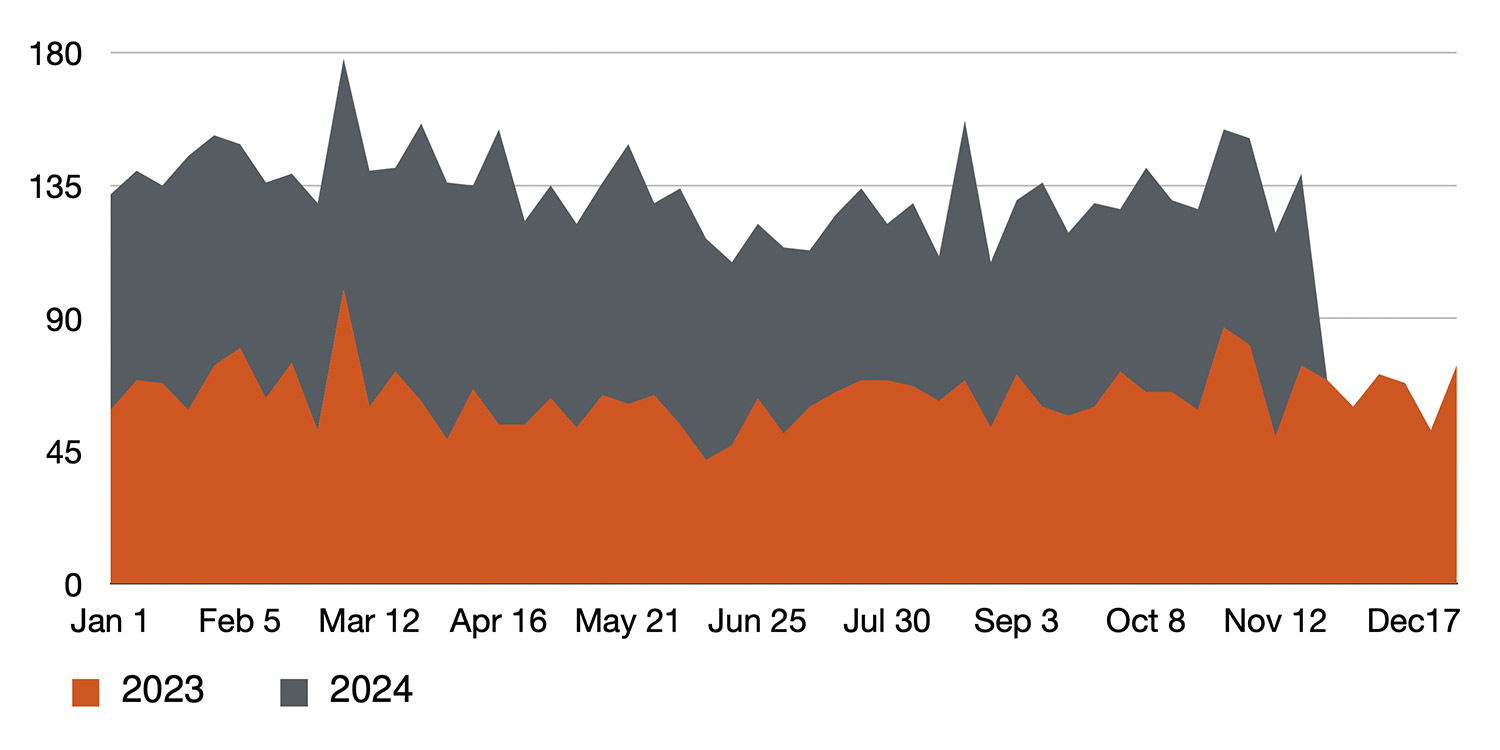

In 2022 alone, more than £300 Million was reported lost to fraudulent cryptocurrency schemes in the UK and EU, surpassing the previous year by 40%. As of 2024, digital fraud remains the most significant threat in the fraud landscape. Data from Google trends indicates that search terms like "phishing," "ransomware," "identity theft," and "app fraud" have consistently ranked high throughout the year, with notable spikes following large-scale data breaches involving social media and e-commerce platforms. In 2024, there has been a higher search volume for "Crypto Fraud" than in 2023, suggesting an increased interest or concern in the topic, however it is noted that there is a similarity in the trend for both years with common areas of “spikes” and “falls”.

In early June 2024, regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) and the European Union announced new APP measures to counteract crypto fraud, as well as the shutdown of specific non-compliant platforms.

WORLDWIDE SEARCH VOLUME FOR “CRYPTO FRAUD”. YEAR-ON-YEAR COMPARISON BETWEEN 2023 AND 2024.

Data Cited from - (Google Trends, 2024).

END-OF-FISCAL-YEAR SCAMS AND REGULATORY UPDATES:

The highest spike in this figure is noted around March. Many financial years end in March, especially in countries like India. Scammers often exploit this period to launch fake "tax-related" crypto investment schemes or phony tax relief services, leading to a spike in search queries around crypto fraud as people try to avoid scams tied to tax season. March is also a common time for regulators in various countries to announce new policies or enforcement actions to start in line with the new financial year. For instance, in past years, countries like India, Japan, and South Korea have rolled out significant crypto regulations in March, which has often led to spikes in searches on crypto fraud and regulatory compliance around this time.

August appears to be another month characterised by the high activity. The spike in search volume related to digital fraud in Google Trends for 2024 can often be attributed to:

- Seasonal phishing and social engineering scams.

- Back-to-school scams affecting students and parents.

- Increased e-commerce fraud during a high-transaction period.

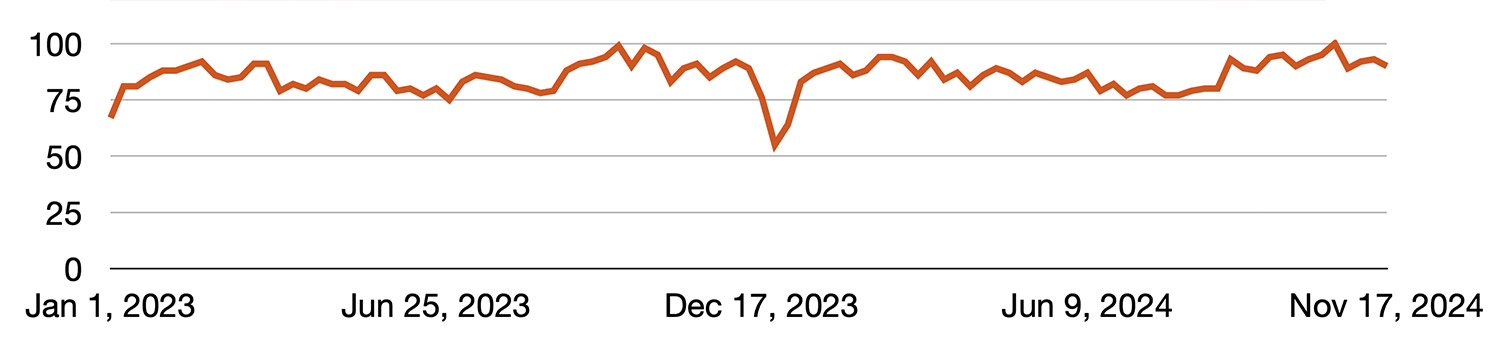

Though several anti-fraud measures exist, we have also seen the emergence of newer types of fraud in the past year. Specifically, the area of cryptocurrency-related fraud remains a focal point of concern. In the UK, with Authorised Push Payment (APP) fraud causing a loss of £341 million in 2023 alone, phishing attacks continue to dominate the landscape, evolving in sophistication. Attackers are increasingly using artificial intelligence to craft convincing phishing emails that mimic trusted sources, making detection challenging for both individuals and automated systems. Ransomware attacks have also surged, marking a 15% increase from 2023.

WORLDWIDE SEARCH VOLUME TREND FOR “PHISHING” FOR 2023 TO 2024.

Data Cited from - (Google Trends, 2024).

Geographic fraud trends in the past five years

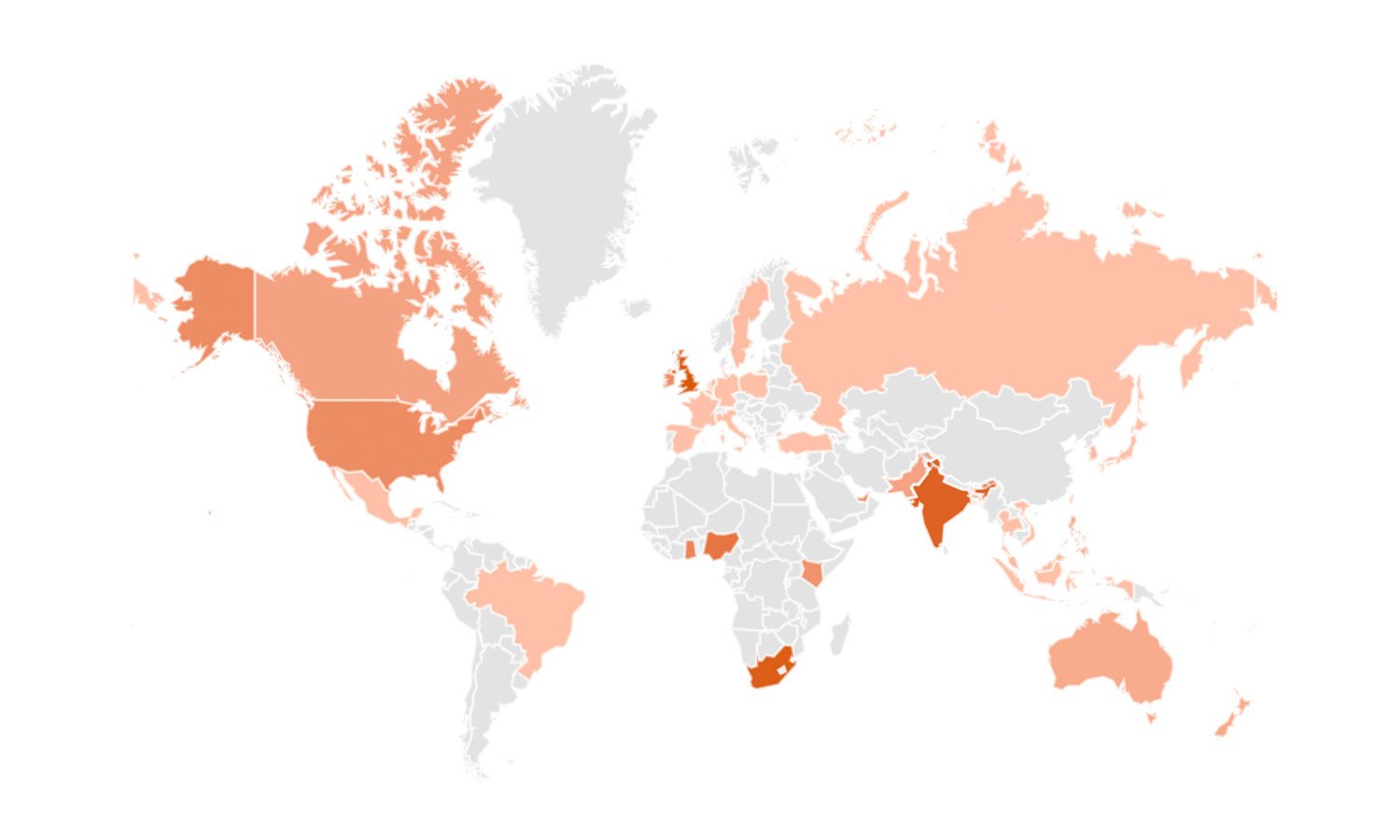

WORLDWIDE GEOGRAPHIC TRENDS: “APP FRAUD” SEARCH VOLUME 2024.

Data Cited from - (Google Trends, 2024).

In 2024, payment fraud remains a global concern, affecting countries across Europe, Asia, Africa, North America, and Australia. The data indicates notable search interest or reported incidents in both developed and developing regions, reflecting the worldwide nature of payment fraud risks.

However, there is a particular concentration of activity in digitally advanced countries such as the UK, Ireland, Singapore, South Africa and the United States. This trend likely correlates with the higher digital transaction volumes in these regions, where the prevalence of online and cashless payments may increase exposure to payment fraud. Additionally, these countries often have more developed fraud detection and reporting systems, along with regulatory frameworks that drive public awareness and education efforts. Consequently, higher search volumes in these areas could also reflect a combination of greater digital adoption, regulatory focus, and public vigilance around payment fraud.

- Regional focus on fraud prevention: The high levels in specific countries like St. Helena, UK, and Singapore could reflect greater efforts in fraud awareness or regulatory activity in 2024, which might drive increased search behaviour as people educate themselves on payment fraud.

- High digital payment penetration: Countries with higher digital payment usage (e.g., UK, Singapore, Australia) are more exposed to fraud risks, potentially explaining the moderate levels in those regions.

- Event-driven spikes: For St. Helena, the extreme spike might indicate a specific, high-impact fraud event that received media coverage, prompting high search interest in that region.

WORLDWIDE SEARCH VOLUME FOR “APP FRAUD” OVER THE PAST FIVE YEARS.

Data Cited from - (Google Trends, 2024).

Regional trends by continent

Europe: The United Kingdom and Ireland lead in search interest for Authorised Push Payment (APP) fraud indicating heightened public concern and changes in regulation. Other countries with notable search activities include the Netherlands, Bulgaria, Romania, Sweden, and Belgium.

North America: The United States dominates search volumes for digital fraud, with Delaware, Nevada, Nebraska, New York and Georgia showing the highest state-level interest. The FTC notes that Delaware's high fraud rate is tied to its status as a corporate hub, making it a target for business-related fraud, while Nevada’s gambling industry contributes to higher instances of gaming-related fraud, such as credit card and account takeover fraud.

Africa: Ethiopia, South Africa, Nigeria and Kenya show the highest search volumes related to APP fraud, partly due to rising digital adoption. World Bank data highlights Ethiopia’ digital growth, which has brought increased exposure to online fraud targeting in-experienced users in new financial systems. the increased vulnerability to digital fraud, including APP fraud, which often targets less-experienced users in new financial systems.

Asia: Singapore and the Philippines top-fraud related searches in the region, followed by India, the United Arab Emirates, and Malaysia, reflecting a strong awareness of, or susceptibility to, online fraud risks.

Australia: Australia is the primary source of fraud-related searches in the region with, with New Zealand following in a distant second.