How Payments Giants Are Harnessing AI to fuel growth

31 May 2024Introduction

As the world of fintech continues to evolve, the integration of Artificial Intelligence and other new technologies into cross-border payments is rapidly reshaping the landscape. While some companies have embraced AI as a primary focus, leveraging it to enhance customer service, sales, and operational efficiency, others are only beginning to explore its potential applications.

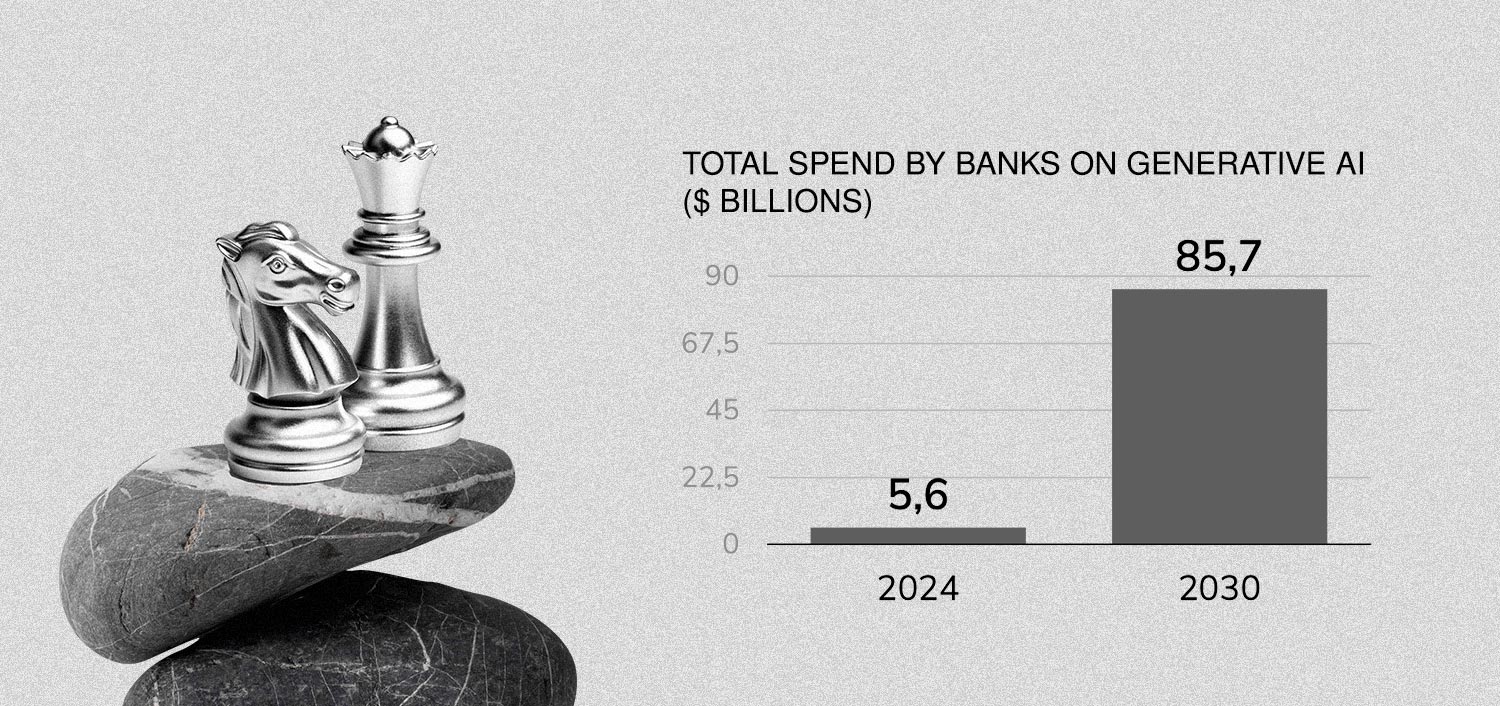

Already, major banking players like Bank of America, Wells Fargo, BlackRock and Citigroup have announced initiatives around generative AI. A new study from Juniper Research has found that spend on GenAI by banks will reach $85 billion in 2030, from $6 billion globally in 2024, with the key drivers being the need to offer more personalised user experiences, and provide increasingly compelling services at reduced cost.

While headlines around AI generally fall into ‘fear’ and ‘wonder’ categories, the financial industries are mostly eager to proclaim their enthusiasm for AI and its possibilities. But there are some lines of demarcation emerging between those who are actively engaged in deployments, and those yet to commit fully. Among remittance and money transfer players, the use of AI is relatively scarce, bar the notable exception of global money transfer giant Payoneer, which is looking into integrating generative AI throughout its operations.

However, among payment processors, there has been more use of the technology, with companies like PayPal, Block, and FIS giving considerable focus to AI. For example, Block is focused on increasing positive outcomes for sales and customer service through AI.

Digging into earnings calls can uncover tantalising glimpses into which AI applications and other tech innovations are gaining the most attention and investment, to gauge the future direction of fintech. For example, PayPal CEO Daniel Schulman commented during his company's earnings call for its fourth quarter and full fiscal year 2022: “We are putting significant resources behind the modernization of our checkout experience…this includes a drive towards passwordless, one-click native in-app experiences as well as deploying the next generation of advanced checkout using our data and AI capabilities.”

In this report, Ryta Zasiekina, Founder of breakthrough fintech project Concryt, delves into the most recent 2023 earnings calls of the top 10 payment companies worldwide - including Visa, Mastercard, Worldline, and Adyen - to gauge which technologies are gaining the most traction in 2024 and beyond.

Worldline

WHO THEY ARE:

Founded in France in 1974, Worldline SA has been part of Europe’s payment infrastructure for decades, and is now one of the continent’s biggest merchant services firms, with a significant presence in digital payments - they were the first company to offer mobile payments in 2017.

WHAT THEY SAY:

“We will accelerate the development of our proprietary GenAI tool to improve, for example, merchants onboarding performance and assisted KYC or to increase the quality of the user experience or international efficiency.”

As a major player in payments, Worldline has been working with AI since long before the current Generative AI boom - a 2021 whitepaper talks about the use of AI to enable ‘hyper-automation’, and like many companies processing vast amounts of payments they have used algorithmic and machine-learning tools to extend their capacities.

More recently, Worldline announced that they would be using Large Language Models (LLMs) in cooperation with Google by using the Google Cloud service. Google Cloud effectively allows Worldline to add a massive amount of computing power and storage very quickly, since they’ll be using Google’s own cloud servers instead of having to build their own.

According to Worldline, they “will access Google Cloud's data analytics and AI to improve insights from Worldline's existing data to build new payment products, merchant services, streamline customer engagement and boost the use of low-carbon technology to expedite green strategies for clients.”

Currently, AI is being used for processing client data, particularly data relating to fraud, since AI can spot the patterns relating to fraud in the vast amount of data that passes through Worldline’s systems every day.

Interestingly, the company is using LLMs in its customer experience (CX) systems. Details are scant at this time, but it seems that they will be using LLMs to communicate with customers directly - essentially as chatbots. These have been used in customer service for many years, but previously were very primitive - essentially canned replies to pre-set questions. Using LLMs may make them much more like speaking to a human being, and could be a new step in how companies work with AI.

Global Payments Inc (GPI)

WHO THEY ARE:

This US-based payment services company recently merged with processing giant TSYS to form a global fintech behemoth with revenue in excess of $7.4 billion per annum.

WHAT THEY SAY:

“We remain committed to harnessing the power of generative AI to both innovate new products and solutions that deliver value and improved experiences to our customers and increase the productivity and efficiency of our operating environments and workforce around the globe.”

Like Worldline, GPI has been using AI for several years to automate alternative payments, customer experience (including chatbots), reducing false card declines and preventing fraud.

Again, much like Worldline, one of their key uses for AI is chatbots, and it is very likely that with the addition of LLM technology these chatbots will become more sophisticated. What is unique to GPI is the use of AI in reducing friction on payments.

There are various ways in which payments can take longer and be less reliable, and given the sheer number of payments and the number of reasons that they can fail, AI is an ideal way to solve payment friction problems.

This is particularly important when new forms of payment are being used - it is much easier for an in-person (or ‘card present’) payment to be processed than a payment that takes place online, or one that uses even newer forms of payment like eWallets or biometrics. GPI, for example, are using AI to improve the accuracy, and therefore reduce the friction on, payments that use ‘Pay By Palm’ biometric technology, making them as quick and easy as card-present payments.

According to GPI’s most recent earnings calls, it’s already made meaningful progress in its journey to embed generative AI into its business to leverage its power and the richness of data in its ecosystem. “We have established a centre of excellence to coordinate our adoption of generative AI technologies and provide a governance framework, implemented foundational tools and models that are being utilized throughout our organization, evaluated numerous use cases and deployed generative AI technology in a number of areas of our business. For example, in our Issuer Solutions business, our Foresight solution, in partnership with Featurespace, provides a market-leading fraud solution that uses generative AI to detect fraud strategies in real-time, utilizing our proprietary data. Clients using this solution have realized a nearly 50% reduction in fraud losses.”

Adyen

WHO THEY ARE:

A Dutch payment company and acquiring bank that allows merchants to accept various payment types, with €1.3 billion in revenue and 27 offices around the world. Following a profit warning in August 2023, Adyen’s fortunes quickly improved in early 2024 when it reported it had processed a total of €544.1 billion in payments in the six months to December 2023, up from €421.7billion in the year-ago period. That led to an 18% increase in its share price and a total market capitalization of €44 billion.

WHAT THEY SAY:

Adyen are an outlier in that they only mention AI very briefly in their most recent earnings call, and then only in response to a question about regulatory AI. However, a quick Google search shows that they have a very mature AI project and a solid understanding of the technology and its limits. Like many companies, Adyen uses AI to spot trends in payments and thereby optimise their payments system and spot fraud. It also uses LLMs to personalise customer experiences, though the company doesn’t seem to be using AI chatbots.

It is in another document that we see their more considered approach to AI. The writer says that ‘quite common and understandable that our urge to fidget with the new technology prompts us, engineers, to find problems to solutions - instead of solutions to problems,’ and this seems to be a quite common phenomenon in AI projects. Adyen has identified a use case for LLMs however:

“We aim to use Natural Language Processing to quickly route support cases to the right specialist, accelerating resolution times. Similarly, we use generative AI and LLMs to provide answer suggestions to empower our operations teams, much like having the correct diagnosis and treatment readily available bolsters efficiency in solving problems.”

Provided this works, this would make customer service quicker and more accurate, while reducing Adyen’s staffing costs.

Block

WHO THEY ARE:

Previously known as Square and with a board that includes Jack Dorsey and Jay-Z, Block are a company that seriously disrupted payments when they launched, and today it’s worth $27 billion, with services ranging from banking, stock and cryptocurrency trading and even the music streaming platform Tidal. Its Cash App money transfer service now boasts more than 50 million active monthly users.

WHAT THEY SAY:

“As we look longer term, of course, there are new technologies like AI that we can be leveraging in-house not only in terms of the product that we're serving our customers but that deliver efficiency to our teams internally, whether it's customer service or sales or engineering and design. And then, of course, structural costs, which we've already made some headway on with some partner renegotiations last year, but we'll continue to pursue in terms of unit economic improvement across our base of products.”

Block introduced ten generative AI features in October 2023 that sellers can use to automate their workflows. It should be noted that these are not payments related: being able to generate copy for product descriptions or background for product images for instance. Aside from standard uses of machine-learning in fraud detection and optimisation it seems that Block are doing little in the AI space that improves the back-end of payments.

Some in the fintech industry have said that despite the name change and celebrity board appointments, Block is struggling to define themselves as many other companies adopt their online-first perspective - its stock sank by 36% during 2023, though it did beat its earnings estimates.

PayPal

WHO THEY ARE:

Arguably one of the most recognisable brand names in payments after Visa and Mastercard, PayPal revolutionised payments in the 2000s by being online-only. Now present in 200 countries, it has continued to innovate, adding features like crypto trading, and had annual revenue of $29.77 billion in 2023.

WHAT THEY SAY:

“This year, we're launching and evolving a new PayPal app to create a situation. We will also leverage our merchant relationships and the power of AI to make the entire shopping experience personalized for consumers while giving them control over their data.”

“We're leaning into demand generation and actually solving the biggest challenge that our merchants have, which is finding new customers as we think about our advanced offers platform or creating shopper insights so that our merchants can start to engage and personalize their experience through our data and through the AI that we can lean through.”

Dig deeper and you’ll find that the company has not only been using AI and ML tools for years, but are launching a suite of new AI products.

For example, PayPal is using AI to optimise its new checkouts and a service called ‘Fastlane’ that allows users to autofill payment information, similar to Google’s Pay system. Smart receipts will also use AI to predict what a customer might want to buy from a company next, and an Advanced Offers Platform will do the same with offers. This isn’t a million miles from the algorithmic ads that search and social media companies serve based upon your use, and doesn’t seem to use the full potential for generative AI. Their only article that mentions the technology does not promise any specific uses for it, so we can only presume that there are none to be released in the immediate future.

Visa

WHO THEY ARE:

One of the world’s oldest, largest and most valuable payment companies, Visa boasts a global network, and a vast product portfolio ranging from credit and debit cards to merchant payments and anti-fraud solutions. Visa’s annual revenue for 2023 was $32.653B, a 11.41% increase from 2022, with more than 212 billion processed transactions.

WHAT THEY SAY:

Surprisingly, Visa didn’t mention AI once during its most recent earnings call, but there are plentiful references to it throughout the company’s other material.

As this article notes, Visa has been using AI in some form (usually machine learning) for thirty years. Primarily, this has been to ‘fight fraud and improve payments’. For example, Visa’s Cybersource Decision Manager uses machine learning and Visa’s database of transaction data to spot patterns that could indicate fraud and risk.

More recently, the company has begun to investigate generative AI and its possibilities for its clients. Despite Visa’s lack of fanfare around AI in its earnings call, the company is planning to spend $100 million on generative AI in the near future, though exact details haven’t been shared. We do know that Visa is launching an AI advisory practice that allows clients to access Visa’s considerable skills with AI through Visa’s Consulting and Analytics network. This will allow Visa to ‘guide clients through their AI journey’, focussing on strategy, capability assessment and model design.

Mastercard

WHO THEY ARE:

Along with Visa, Mastercard is one of the world’s largest payment network companies, with a major share of the world’s credit and debit cards and hundreds of products for both enterprise and consumer customers. Mastercard’s annual revenue for 2023 was $25.1 billion, a 13% increase on 2022. A large portion of that growth came from its cyber and intelligence solutions, scaling of its fraud and security solutions, as well as continued growth in its marketing, data analytics, consulting, and loyalty solutions.

WHAT THEY SAY:

“We also continue to develop new services and solutions, many of which leverage the work we are doing with Generative AI. Generative AI brings more opportunity to drive better experiences for our customers, and makes it easier to extract insights from our data.

“It can also help us increase internal productivity. We're working on many GenAI use cases today to do just that. For example, we recently announced Shopping Muse. Shopping Muse uses Generative AI to offer a conversational shopping tool that recreates the in-store human experience online, can translate consumers' colloquial language into tailored recommendations.”

Like its rival Visa, Mastercard has an extensive range of generative AI tools in development. For example, in its earnings call Mastercard talks about a tool called Mastercard Small Business AI, which provides ‘personalised real-time assistance delivered in a conversational tone’. This and other AI tools are available through Mastercard Access, which provides a large number of services to Mastercard’s enterprise customers.

Mastercard is also using AI in fighting real-time payment scams through its Consumer Fraud Risk solution and using AI in customer service roles.

American Express

WHO THEY ARE:

This multinational three-party payment network and financial services company has a slightly lower market share than its four-party rivals Visa or Mastercard, but is still one of the world’s largest providers of credit and debit cards alongside a wealth of other services. American Express reported record full-year 2023 revenue of $60.5 billion, up 14% from the year-ago period.

WHAT THEY SAY:

AmEx had no reference to artificial intelligence in its earnings call, but there are numerous articles about the company’s work in the field.

Despite the lack of focus on the subject in its earnings call, AmEx is undergoing an ‘AI revolution’. AI is used, for example, to extract information from printed receipts in order to complete expense forms, with another system assigning a risk score to the transaction to make the approval process quicker. One article notes that they are “looking towards forming strategic partnerships” with AI companies, which would indicate that they will work with companies like OpenAI or Microsoft rather than develop an AI solution in-house.

Fiserv

WHO THEY ARE:

As a multinational financial technology and payment solution provider, Fiserv services banks, card schemes, stockbrokers and mortgage, insurance and leasing companies. Following its 2019 acquisition of payment processor First Data, Fiserv became one of the largest global fintechs, with an 8% increase driving 2023 revenue up to $19.1 billion compared to the prior year.

WHAT THEY SAY:

“The power of our data fueling AI applications is already helping us throughout our business in areas such as enhanced customer service, analytics on the Clover and Carat dashboards and fraud mitigation tools.” Fiserv highlights some key ways it’s turning data into an “increasingly potent AI asset”.

“First, we're creating better service and insights for our clients by helping them harness data in actionable ways. As an example, 85% of technical service calls were resolved unassisted through the use of data and AI with high client satisfaction rates. Additionally, over the last year, more than two million of the highest-level technical support inquiries resolved online through AI assisted learning. Second, we're embedding our data and AI capabilities into value-added solutions such as Advance Defense being used to combat fraud and other security risks.”

Since it has access to huge amounts of data from its clients across multiple industries, Fiserv is able to analyse a very large dataset, giving it good insights into its customers.

Like many companies, Fiserv has been using machine learning for fraud for many years, but is increasingly looking to explore generative AI, including an application that we haven’t seen from another company: checking customer phonecalls and other communications for signs of fraud in a customer’s speech patterns. Fiserv is also building tools to “(predict) how our customers are going to perform over time, enabling better financial planning and decision-making.”

FIS

WHO THEY ARE:

Fidelity National Information Services, Inc. better known as FIS, is a multinational fintech company based in Florida, with 65,000 employees. In 2023, FIS reported revenues of $2.5 billion, a fall of 1% compared to the prior year. During the year, FIS sold a 55% stake in its Worldpay Merchant Solutions business to private equity funds managed by GTCR.

WHAT THEY SAY:

FIS didn’t mention AI during its latest earnings call.

Although FIS has dozens of articles on AI in banking and payments, there is little information on its own work with AI.

It does however have a tool called “AI 360”, which identifies a company’s “most engaged customers based on the full value of their banking relationship across all product lines, with differentiating rewards related to waived fees, lower interest rates, cash back and more.”

Like many companies, FIS has an AI anti-fraud tool, created in partnership with the company Stratyfy, which identifies fraudulent card transactions.

Conclusion - What Does This Tell Us About AI in 2024?

The first and perhaps most important fact that the above analysis shows is that every major fintech and finance company has some form of AI-based technology - but many, including giants like Visa, don’t consider it a topic of conversation when giving their earnings reports. Considering that AI is one of the biggest tech trends of the past year, it seems likely that mentioning it would reassure investors that a given company is staying ahead of the curve, so why did many not mention it at all?

A key reason is that while generative AI is relatively new, as Visa and others point out, AI has been used in finance for decades. The key use for machine learning has been fighting fraud: it is far easier to spot patterns that indicate fraud in the massive amounts of information moving through a payments company each second with machine learning than through the work of human operators.

So what can generative AI do? We can see examples from companies like Adyen and Mastercard who are using AI to provide customer service - generative AI can create a reasonable facsimile of a human and can therefore be used for basic customer service tasks. We already see how chatbots and voice recognition have been used in CX applications, and generative AI, which is far more human-sounding, can only extend this. This has its limits: most people contact customer services when they need something done, and AI will mostly be routing customer service requests to human operators if something important needs to be done. Many of the companies above have extensive B2B operations, and this kind of AI-based interaction won’t be able to replace client relationship managers in those more complex transaction segments.

The second major use case is analysis. This isn’t exactly in the wheelhouse of the current generation of generative AI, which largely generates text or images, but it is similar. Just as large language models analyse very large amounts of data to be able to convincingly imitate human language, AI systems can trawl through millions of data points created by a financial services company’s customers and create some level of sense from them, giving companies themselves or customers actionable insights. This will only be as good as its programming, and could give bad-quality predictions in the same way that LLMs will periodically ‘hallucinate’.

WHAT CAN WE CONCLUDE ABOUT AI’S PLACE IN FINTECH FROM THIS?

- The financial services industry has extensive experience with AI, so major players aren’t easily taken in by hype. Many articles by these companies include language about ‘seeing through the hype’ or ‘getting to real facts about AI’.

- LLMs are useful for a small range of tasks, but these are not going to be transformational for companies. Even when they can be used, such as for chatbots, they are going to be limited by the amount of responsibility that an AI can have and B2B clients’ unwillingness to talk to chatbots instead of professionals.

- The interesting applications of AI are happening under the radar, often in parts of the industry that clients won’t get to see. Fraud prevention is one key part of this, but so is optimising the payments process, especially when payments are becoming more complex. With new regulatory frameworks like PSD3 on the horizon, this will be even more important.

What’s certain is that AI’s automation benefits have already made significant transformations in banking and financial services in the fields of customer service and process streamlining. Combined with machine learning improving its own cognitive functions with every new byte of data, we are set for a future where, unlike previous big tech stories, such as NFTs, we can clearly see that AI has a place in the fintech industry, and there are new use cases being actively developed that will change the ways that the industry works at a deep level.